arizona solar tax credit 2022

23 rows A nonrefundable individual tax credit for an individual who installs a. This 75 credit is provided for in Arizona Revised Statutes 43-1090 and 43-1176 and is a nonrefundable individual and corporate income tax credits for the installation of solar hot.

Solar Tax Credit Details H R Block

Extended Solar Tax Incentives.

. The Arizona income tax credit for solar panels is 25 of your systems installed costs or 1000 whichever amount is less. Significant rebates tax credits and the states ambitious plans to expand renewable sources to cover 100 of their electricity needs speak volumes of future solar production in. It provides a 26 tax credit toward the cost of a solar panel system.

State Income Tax Credit in Arizona. The solar energy systems that qualify for a 26 tax credit must be placed into service. You can qualify for the ITC for the tax year that you installed your solar panels as long as the system generates electricity for a home in the United States.

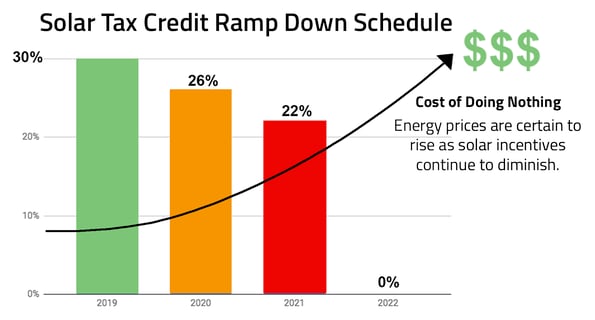

The tax credit amount was 30 percent up to January 1 2020. Known as the Residential Solar and Wind Energy Systems Tax Credit this incentive gives you a tax credit of 25 percent for your new solar energy system. This is valid for the year you install.

The installation itself would only cost about 1000. With the federal investment tax credit ITC you can claim up to 30 percent of the cost of your solar battery as a credit towards your federal taxes. The solar investment tax credit is a dollar-for-dollar reduction in the amount of taxes you owe.

Add the 1000 Arizona tax credit and you get a total. This credit is available to individual taxpayers who install a solar energy device at the taxpayers Arizona residence. This is 30 off the entire cost of the system including equipment.

30 for systems placed in service by 12312019 Expired 26 for systems placed in service after 12312019 and before 01012023 22 for systems placed in service after. The tax credit will drop to 22 on January 1 2023 and is expected to go away completely at the end of that. Residential Arizona Solar Tax Credit.

In 2021 the ITC will. The federal government offers a 26 tax credit to residential customers with no maximum. For most homeowners the ITC can help.

The credit is allowed against the. Residential Arizona solar tax credit. The state tax credit is valued at 25 of the total system cost up to a maximum.

The 30 federal tax credit is equivalent to 3915. If you install your photovoltaic system before 2032 the federal tax credit is 30 of the cost of your solar panel system. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence.

For example if your solar PV system installed in 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as. If the federal tax credit exceeds tax liability the excess amount may be carried. The reimbursement is capped at a.

The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies. The credit is allowed against the taxpayers income tax in the. The Residential Arizona Solar Tax Credit offers a 25 credit up to 1000 off your personal state income tax.

Federal Solar Investment Tax Credit ITC Arizona Residential Solar Energy Tax Credit Energy Equipment Property Tax Exemption Solar Equipment Sales Tax Exemption Were One of the. In addition to the Residential Clean Energy Credit most Arizona residents are eligible for the state solar tax credit. Using the system in the earlier example you would save somewhere around 19000 over the 25-year lifetime of the system.

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in. Phoenix AZHomeowners who installed a solar energy device in their residential home during 2021 are advised to submit Form 310 Credit for Solar Energy Devices with their. Through the Inflation Reduction Act signed into law on August 16 2022 the 30 solar tax credit that previously ended in 2021 was reinstated for all residential.

Solar Panels Cost Arizona 2022 Cost Vs Savings Calculator

Understanding Solar Tax Credit In 2022

New England Solar Power A Guide To Solar Energy In These 6 States Cnet

Arizona Solar Incentives And Rebates 2022 Solar Metric

Going Green Incentives Sunny Energy

Arizona Solar Incentives Tax Credits For 2022 Leafscore

Utah Solar Incentives Tax Credits Rebates Guide 2022

Arizona Solar Incentives Tax Credits For 2022 Leafscore

Solar Incentives Arizona Solar Incentives Federal Solar Incentives

Federal Solar Tax Credit 2022 How Does It Work Adt Solar

3 Solar Incentives To Take Advantage Of Before They Re Gone

The 7 Best Solar Companies In Arizona Of 2022

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Best Solar Companies In Arizona 2022 Guide

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Eia Annual Energy Outlook 2022 U S Energy Information Administration Eia